Traditionally, following the sale of an appreciated property, the capital gains taxes could only be deferred by executing a 1031 Exchange, which can still be a legitimate path depending on the situation. However, many investors/property owners are not dealing with transactions that would qualify for 1031 treatment. Only property that has been held for investment purposes can be involved in a 1031 Exchange. Additionally, there are very strict time constraints that apply to each Exchange that can make closing on the replacement property difficult. If any of the time limitations are not adhered to then the 1031 would fail and the entire tax would become due.

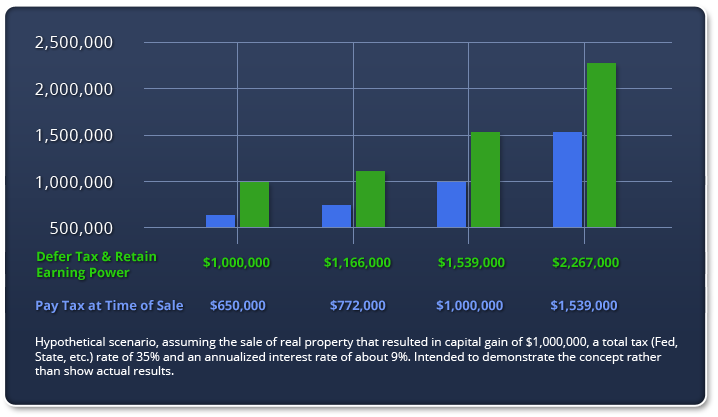

At Max Cap Financial, we work closely with firms who provide 1031 Exchange services for our clients who choose that option, but more importantly, together, we are able to offer a 1031 “Safety Net”. The “Safety Net” is referred to as a Deferred Sales Trust, or DST. When structured properly, the DST can allow the taxes to be deferred, even in the event of a failed 1031. If you are unable to successfully acquire suitable replacement property or just prefer to transition into non-real estate related products, we have options available that are designed to defer the capital gains tax for many years, and even in perpetuity, in some cases. We can help you retain the maximum value and earning power of the pre-tax sale proceeds which, for many of our clients, means that they can retire earlier, live more comfortably and even give more generously than they could have with “after-tax” dollars.

We are not only able to assist you in maintaining and growing your wealth after the sale of investment property, but now we are able to utilize the same principles and apply them to transactions involving Businesses (of any size), Medical/ Dental Practices, Stocks/ Crypto Currencies, Primary Residence, or Vacation Home. Instead of paying 35% or more in taxes at the time of sale, our network of experts can help you retain the earning power of the entire amount.

Please call if you have any questions, or if you would like to schedule a free consultation: 888.769.1031